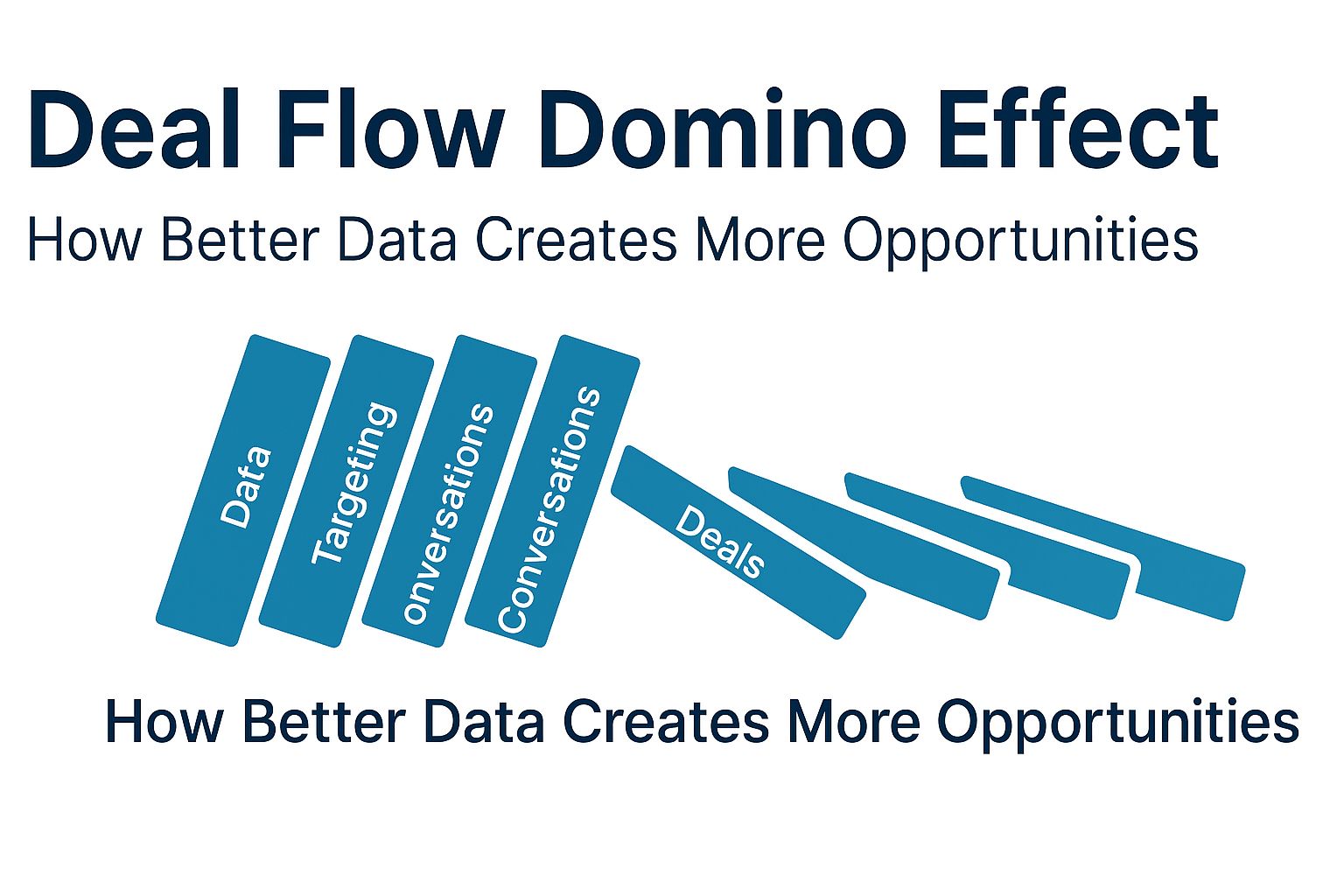

In real estate investing, most people think the first domino is marketing or capital.

But the real first domino the one that quietly determines whether every other piece falls or fails is data quality.

Bad data → wasted time → stalled deal flow → inconsistent months Better data → smarter targeting → faster conversations → more capital → more deals

If your deal flow feels unpredictable, inconsistent, or “lucky,” it’s almost always because the first domino is weak.

This article breaks down the Deal Flow Domino Effect so you can strengthen your inputs, increase your outputs, and engineer a predictable, compounding pipeline.

[ASSET: Image | Search Term: "domino effect business data cascading" | Alt Text: "Domino effect illustration showing data improvements leading to more deals."]

1. The Domino Effect: Better Data → Smarter Targeting → Faster Deals → More Capital

Better data is not just more information it’s a leverage multiplier.

High-quality enriched data improves every stage of your process:

Domino #1 Better Data Improves Lead Targeting

Investors waste hundreds of hours every year chasing low-intent or completely invalid leads simply because their data was wrong, outdated, or incomplete.

Accurate property details, owner information, and motivation insights determine whether a lead is worth your time.

This is where high-quality investors pull ahead they know how to identify real opportunities fast.

👉 Learn more: Quality Leads: What They Look Like & How to Spot Them

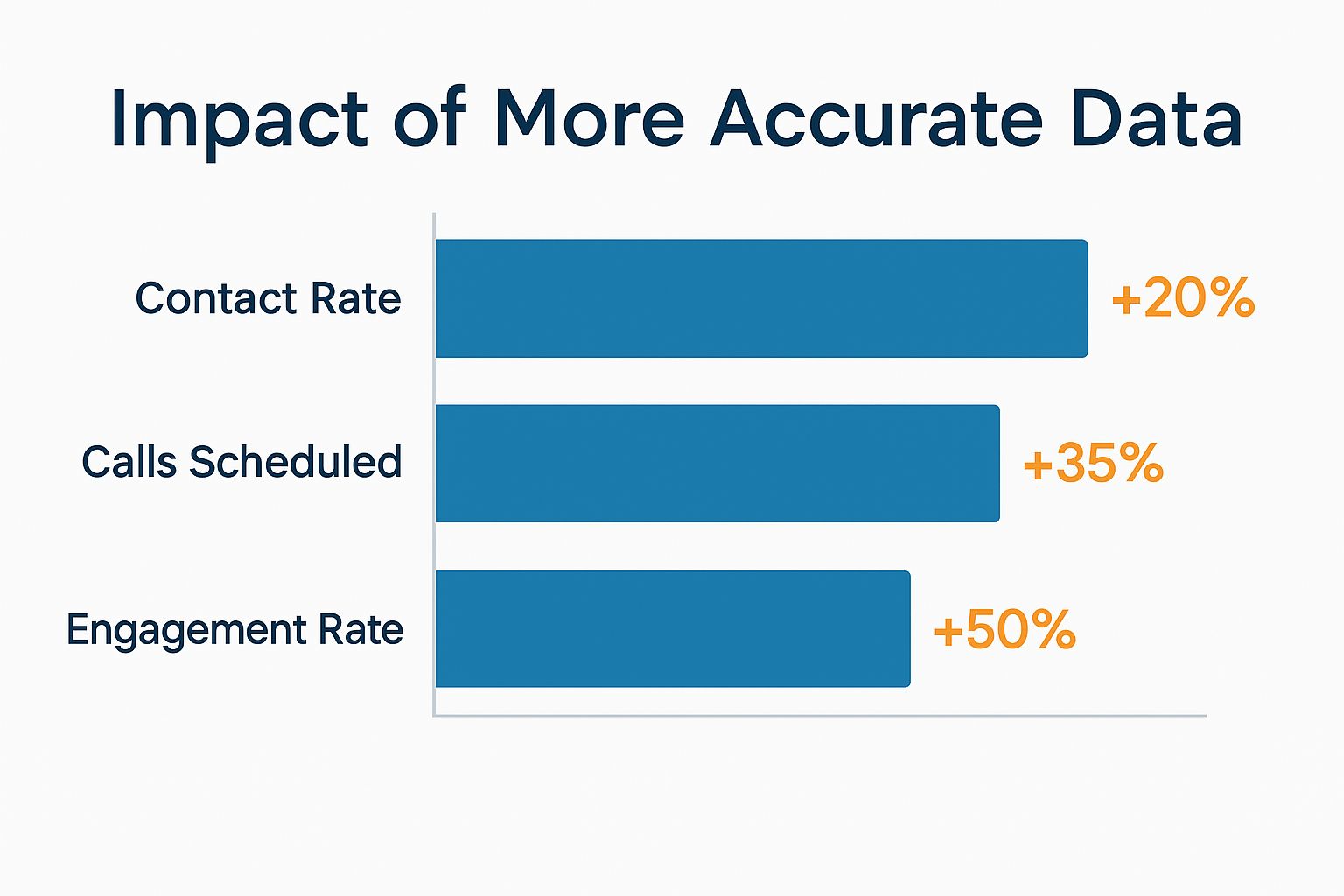

Chart showing how accurate data improves contact and engagement rates.

Domino #2 Better Targeting Produces Faster Conversations

Our analysis of 500+ Deal Scale AI conversations shows a simple truth:

Accurate data = higher engagement = faster progress toward deals.

When your system has correct owner info, valid contact channels, and accurate property details, trust goes up and replies come faster.

Investors who improve data inputs naturally shorten their sales cycle.

Domino #3 Faster Deals Create More Reinvestment Capital

This is the most powerful domino.

When deals close quickly:

Capital returns sooner

You can deploy into more opportunities

You scale faster without spending more

Your deal flow compounds

Small improvements in data accuracy cascade into major improvements in portfolio growth.

2. Common Data Mistakes That Stall Deal Flow (And How to Fix Them)

Most investors don’t struggle because they’re bad at sales… They struggle because their data sabotages them before the conversation even starts.

Here are the biggest offenders:

Mistake #1 Outdated or Incomplete Property & Owner Records

If your data is refreshed every 6–12 months, it’s already stale.

Modern investors use continuously updated:

Tax records

Owner verification

Phone/email append

Property condition indicators

Mistake #2 Cheap Skip-Tracing Creates Expensive Pipeline Blockages

Cheap skip tracing looks like a discount… But it creates invisible costs:

Wasted outreach

Wasted time

Wasted ad spend

Wasted opportunity

Low data accuracy → low deal flow.

You don’t save money you lose deals.

Mistake #3 Relying on Unverified Data Sources Alone

Platforms like CoreLogic or ATTOM provide a strong foundation but investors still need enrichment to produce deal-ready data.

Supporting source: https://www.attomdata.com/news/most-recent/the-ai-trifecta-for-real-estate-algorithms-apis-and-quality-data/

👉 Want to see this in action?

3. How Accurate, Enriched Data Fuels Consistent Lead Quality

When investors fix their data, they fix their deal flow permanently.

This is the Investor Flywheel:

Accuracy → Confidence → Consistency → Scale

Bad data creates “pipeline whiplash”: One good month → one dead month → chaos → randomness.

Enriched data reverses that.

Why Enrichment Matters: Fields That Make or Break Deals

Investors underestimate how many micro-fields drive deal outcomes:

Contact validity

Owner match confidence

Behavioral indicators (distress, timeline, motivation)

Multi-property ownership

Phone/email device match

Rental vs owner-occupied

Verified property details

Property type fit

This is the hidden infrastructure behind consistent deal flow.

👉 Related internal link: How to Get Better Lead Quality

Proof: Better Data Improves Deal Flow

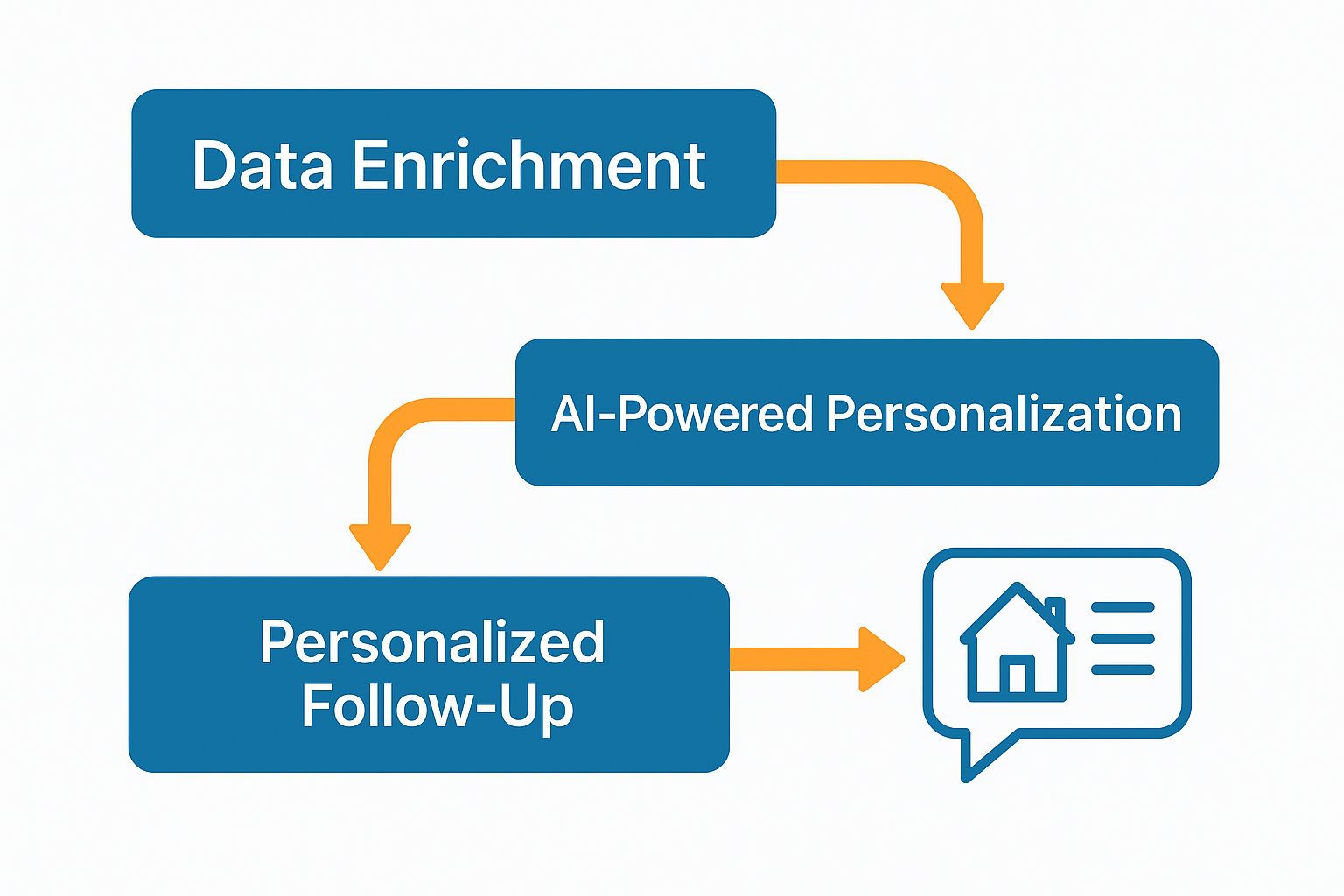

Here’s the visual flow of how enrichment compounds outcomes:

[ASSET: Image | Search Term: "data enrichment flowchart real estate" | Alt Text: "Flowchart showing cascading benefits of high-quality enriched data."]

Flowchart showing cascading benefits of high-quality enriched data.

4. Practical Framework: How Investors Upgrade Their Data for Maximum Deal Flow

Here’s the 4-step system top investors use:

Step 1 Identify Data Weak Points

Look for:

Low contact validity

Missing owner information

Property data inconsistencies

Outdated skip-trace fields

Step 2 Apply Enrichment Layers

The “enrichment stack” usually includes:

Owner cross-verification

Phone/email append

Property database accuracy boost

Behavioral/motivation data

AI-driven lead scoring

Step 3 Automate Data Updates & Accuracy Checks

This is where scaling becomes predictable:

Automatic enrichment refresh

Error triggers (invalid contact → reprocess)

Scheduled update cycles

Verification workflows

Step 4 Connect Enriched Data to AI Follow-Up Systems

Better data → better personalization Better personalization → more replies More replies → more deals

Workflow showing data enrichment feeding into personalized AI follow-up.

Conclusion: Better Data Is the First Domino

If you want:

Higher deal flow

Shorter timelines

More predictable income

Reinvestment capital that compounds

…then you must fix your first domino: your data.

Better data → better decisions → better deals → more opportunity.

The investors who embrace this outperform the ones who rely on outdated lists or cheap skip tracing every single time.

Ready to Improve Your Deal Flow?

Stop relying on outdated or inaccurate data.

See how Deal Scale enriches, corrects, and validates your lead data before it even reaches your CRM.