For decades, scaling a real estate investment business meant one thing: adding complexity. If you wanted to close more deals, you needed more leads, which meant more cold callers, more acquisition managers, and more administrative bloat. Growth was linear, and it was expensive.

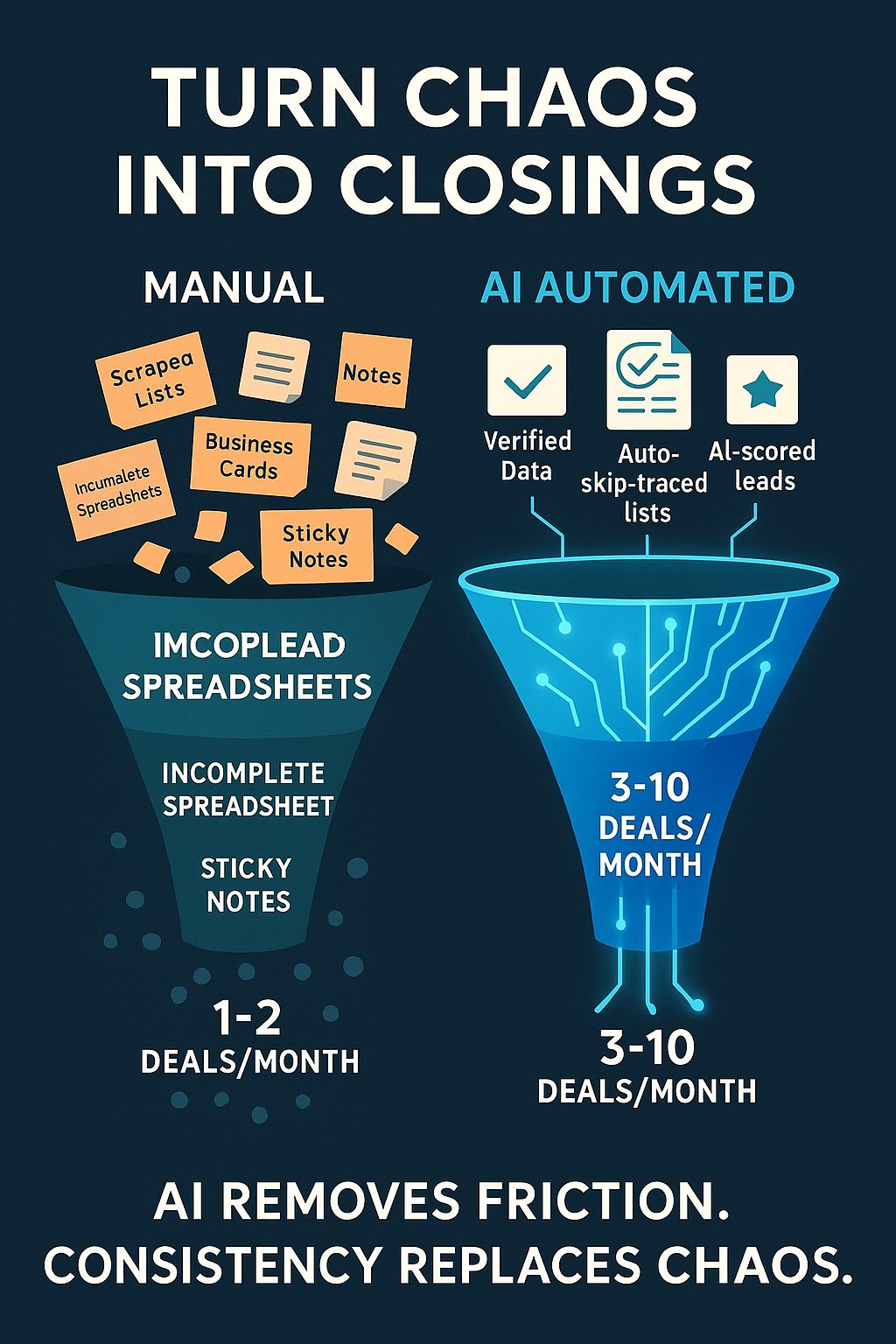

But as we head toward 2026, a divergence is occurring. The market is splitting into two distinct groups. On one side are the "Brute Force" investors, struggling to maintain margins as overhead creeps up. On the other are the "AI-Integrated" investors, who are building operations that are leaner, faster, and significantly more profitable.

The competitive advantage of this decade isn't just access to capital or data; it is operational velocity. It is the ability to process opportunities faster and more accurately than the competition, without adding headcount.

The Shift: From Manual Grind to AI Workflow Integration

The traditional follow-up model is broken. In a manual workflow, a lead comes in, and the speed-to-lead depends entirely on whether your staff is at their desk, on another call, or at lunch.

The operational shift happening right now is the move from human-dependent workflows to AI-first workflows. In this model, AI acts as the "always-on" front line. It doesn't just route leads; it engages them, qualifies them, and updates the CRM in real-time. This ensures that your expensive human talent only spends time on the highest-value activity: negotiating and closing deals.

The Anatomy of an Early Adopter: 3 Key Differentiators

What actually separates the investors who are successfully scaling with AI from those who are just tinkering with tools? It comes down to three operational pillars.

1. Radical Consistency

Human performance varies; AI performance is constant. An AI system follows up with the same persistence and precision on the 100th lead as it does on the 1st. This consistency plugs the "leaky bucket" in your pipeline where millions in potential revenue are lost simply because a human forgot to call back.

2. Intelligent Automation

Early adopters aren't just using auto-responders. They are using conversational AI that can understand context and intent. This allows them to automate complex tasks—like negotiation, data entry, and lead scoring—rather than just simple notifications.

3. Data Feedback Loops

Top investors use AI to learn. Every interaction feeds data back into the system, refining lead scoring models over time. This creates a virtuous cycle where the system gets smarter with every lead it processes. This connects directly to the debate of AI vs. Gut Instinct while gut instinct guides strategy, these data loops validate execution.

A line graph comparing the rapid, scalable growth of AI-driven real estate operations versus the slower, linear growth of traditional manual operations.

Case Study: Scaling Quality, Not Just Volume

Consider the trajectory of a mid-sized investment firm in Phoenix. They were plateauing at about 20 qualified opportunities a month. Their initial instinct was to double their ad spend to get more volume.

Instead, they integrated DealScale’s AI prioritization engine.

Rather than flooding their acquisition managers with more raw leads, the AI filtered and engaged the existing flow, prioritizing leads based on behavioral signals and conversational intent.

The Result: They jumped from 20 to 80 qualified opportunities per month.

The Key: They didn't increase lead volume; they increased lead yield. By stripping away the noise of low-quality leads, their team could focus intensely on the right opportunities. They scaled their output 4x without hiring a single new staff member.

Your AI Readiness Checklist

Transitioning to an AI-integrated operation doesn't happen overnight. Here is the checklist to ensure your business is ready for the shift:

[ ] Audit Manual Touchpoints: Identify every point in your process where a human is manually entering data or sending a generic follow-up. These are your automation targets.

[ ] Centralize Your Data: AI needs clean fuel. Ensure your CRM is the single source of truth for your deal flow.

[ ] Implement an "AI First" Layer: Deploy a tool like DealScale to handle initial inbound response and qualification.

[ ] Define Your Feedback Loop: Establish a weekly review to see why the AI qualified certain leads and adjust your parameters accordingly.

Adapt or Stagnate

As authoritative research from McKinsey & Company highlights, the real estate industry is poised for a massive productivity boom driven by generative AI. The investors who adopt these "smarter, leaner" operations today will define the market of tomorrow.

You can continue to scale by brute force, or you can build an operation that scales by design.

Written by Jordan DealFounder & Real Estate AI Strategist