If you’re investing in 2025 with a team (even a small one), you’ve probably felt it:

The lead is in a spreadsheet

The notes are in texts

The follow-up is in someone’s head

The underwriting is in a Notion doc

The “latest status” is… unclear

And the brutal part is that you can be doing a lot of work and still lose deals simply because your data isn’t connected.

In 2026, the winners won’t be the people with “more information.”

They’ll be the people with shared, synced, trusted data that turns into action.

That’s what data collaboration really is—and why it’s about to become the investor advantage.

The real problem isn’t data it’s fragmentation

Most investors don’t have a lead problem. They have a context problem.

A lead without context looks like:

“Call back later” with no reason why

A property address with no comps attached

A seller conversation with no next step

A warm referral that gets routed to the wrong person

A pipeline that’s “updated” but not actually usable

That fragmentation creates a hidden cost I call the Silo Tax:

Duplicate work (same research done twice)

Dropped follow-ups (because “someone else” thought it was covered)

Stale assumptions (underwriting based on last month’s numbers)

Slow decisions (teams re-litigate details that should be shared truth)

You don’t feel this on day 1.

You feel it when you’re trying to scale.

What “data collaboration” actually means in real estate

Data collaboration isn’t “everyone has access to the folder.”

It’s three things working together:

The basics: leads, properties, contacts, conversations—captured in one place, in consistent fields.

The context layer: enrichment, comps, rental assumptions, motivation signals, tags like “inheritance” or “tired landlord,” and the why behind the deal.

The action layer: tasks, follow-up sequences, routing, reminders, status changes—so the team moves as one system, not five individuals.

If your team can answer these in 10 seconds, you’re collaborating:

What’s the latest status?

What do we know and how do we know it?

What happens next and who owns it?

Why 2026 is the tipping point

Three forces are converging:

AI only works when inputs are clean and connected

AI can’t “figure it out” when your deal story is split across a CRM, a spreadsheet, DMs, and a call log.

When data is fragmented, AI becomes another tool you babysit.

When data is connected, AI becomes leverage.

Speed is compounding now

The gap between “responded in 5 minutes” and “responded tomorrow” is bigger than it used to be—because sellers are overwhelmed and attention is scarce.

Connected data enables:

faster decisions

faster follow-up

fewer handoff mistakes

Teams expect “one view of the deal”

Even small investor ops now run like real businesses: acquisition, dispo, funding, admin, VAs.

Everyone needs the same truth without chasing updates.

The investor use cases that benefit first

Deal sourcing: stop losing leads in the intake phase

If leads come from multiple channels (lists, referrals, inbound, brokers, PPC), your first win is simple:

One intake process → one standardized record → one owner.

That alone reduces chaos and makes performance measurable.

Underwriting: align assumptions so you stop re-arguing every deal

Most teams waste time because underwriting is inconsistent.

Data collaboration means:

shared comp sources

shared rehab ranges

shared buy box rules

shared “deal notes that matter” (tenant risk, zoning issues, access problems)

The goal isn’t perfection—it’s alignment.

Follow-up: make “consistent” feel effortless

Follow-up is where deals are won… and where teams fall apart.

Data collaboration makes follow-up:

consistent (no dropped balls)

personal (context carries through)

scalable (automation helps without sounding robotic)

If you want to feel the difference: compare “checking notes” to “already knowing the story.”

[ASSET: GIF | Search Term: "messy spreadsheets overwhelmed office reaction" | Alt Text: "A humorous GIF representing the chaos of managing deals across too many spreadsheets."]

The Collaboration Stack: what to implement (without buying 12 new tools)

Think of this as a clean stack—not a complicated one.

1) System of record (pipeline + notes + status)

Where every deal lives with:

consistent stages

consistent fields

notes that follow the deal

Start here:

2) Data enrichment (property + contact intelligence)

Not every lead comes in complete. Enrichment fills the gaps so the team doesn’t waste time doing manual research.

Explore:

3) Automation layer (routing + follow-up + reminders)

This is where collaboration becomes real.

Automation should:

assign owners

trigger next steps

remind the team

keep momentum moving

If your “system” depends on perfect human memory, it’s not a system.

4) Visibility layer (dashboards + bottlenecks)

You can’t improve what you can’t see.

Dashboards should answer:

where deals stall

what sources perform

how long stages take

who needs support

See:

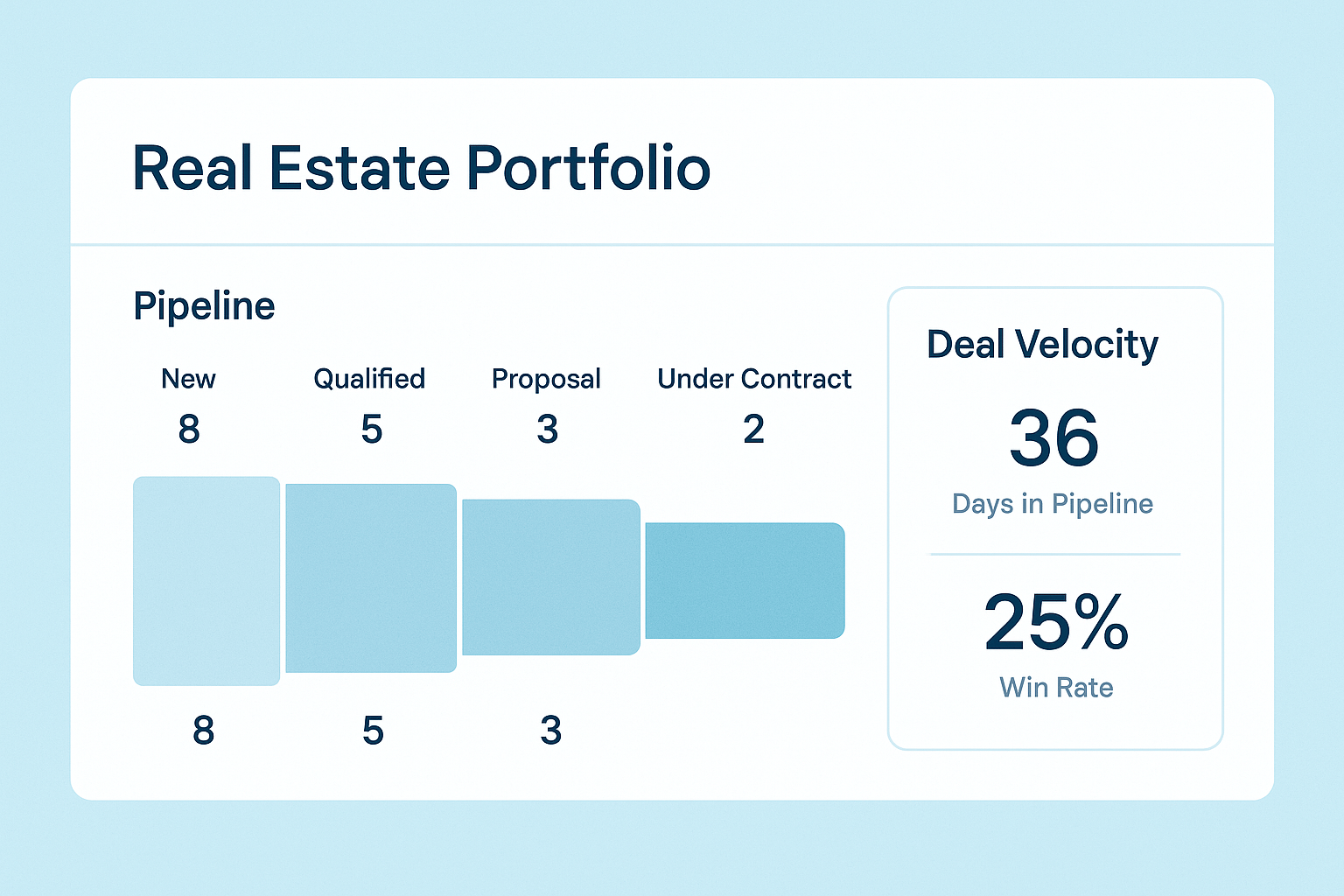

A clean real estate portfolio dashboard showing pipeline stages and deal velocity metrics.

Rules of the road: governance without slowing down

Collaboration fails when it becomes “everyone can edit everything.”

Here are lightweight rules that keep speed and sanity:

Ownership & permissions

One deal owner

Clear handoffs between acquisition → underwriting → dispo (if applicable)

VAs can update fields, but decision fields require approval

Standard fields (the minimum viable “shared language”)

Pick 10–15 fields you commit to using consistently:

stage

source

motivation tags

next action

next follow-up date

offer range

decision status

notes

Consistency beats complexity.

Auditability

If someone changes a key field, it should be trackable.

Not because you don’t trust people—because systems need accountability.

A simple 30-day rollout plan (so this doesn’t die in a meeting)

Week 1 Map your data flow

List every place leads enter:

lists

inbound forms

referrals

brokers

cold outreach replies

Document where they go today (and where they get lost).

Week 2 Standardize stages + required fields

Define pipeline stages in plain English.

Make 5–8 fields required.

Week 3 Connect intake → enrichment → follow-up

Set rules like:

“New lead gets enriched within 24 hours”

“Every lead must have next action + next follow-up date”

“Warm leads trigger a follow-up sequence”

Week 4 Review metrics + tighten the loop

Measure:

response time

stage velocity

follow-up completion

conversion by source

Then improve one bottleneck—not everything at once.

Where DealScale fits (and why this feels easier than you think)

DealScale exists for the exact moment investors hit:

too many sources, too much manual effort, and follow-up that depends on willpower.

With DealScale, the idea is simple:

Import anything (spreadsheets, CRMs, inbound sources)

Enrich and normalize so your pipeline isn’t full of blanks

Trigger action automatically—follow-up, routing, reminders, CRM updates

If you want a quick visual of how this works:

And if you want proof that implementation is the real blocker (not “lack of tools”):

For deeper reading on follow-up systems:

The takeaway: Collaboration is the new compounding advantage

In 2026, the best investors will still hustle.

They’ll still underwrite.

They’ll still negotiate.

But they won’t do it alone—and they won’t do it blind.

They’ll build a system where:

every lead has context

every deal has an owner

every stage has a next step

every follow-up actually happens

That’s what data collaboration gives you: less chaos, more control, more momentum.