This is the story of an established real estate investor who hit a familiar wall. Their team grew. Their deal volume increased. Their systems did not. The operation began choking on its own complexity until they rebuilt their workflow around a centralized, AI enhanced deal desk. What happened next redefined their speed, collaboration, and clarity. This article walks through the full transformation and shows how today’s most effective investors operate behind the scenes.

Established investor surrounded by spreadsheets and disconnected tools showing workflow chaos

Growth in real estate does not break businesses. Inefficient systems do. This investor had experience, deal flow, and a capable team, but the internal machinery powering their operation was showing cracks that had gone unnoticed for years. What began as minor inconveniences eventually became operational blockers. A spreadsheet that once worked suddenly collided with a CRM that no one updated consistently. Seller follow ups slipped during busy weeks. Documents were spread across emails and personal devices. The team spent more time untangling information than moving deals forward.

This is the kind of friction that does not appear in revenue reports or pipeline snapshots, yet every operator feels it. At a certain stage of growth, complexity increases faster than capacity. The investor found themselves reacting to problems instead of controlling their workflow. And the more they pushed for efficiency, the more the system pushed back.

The breakdown was not loud. It was slow. But it was real.

The Investor’s Challenge

The investor’s operation looked strong from the outside. They managed multiple markets, ran consistent lead generation, and had a steady acquisition pipeline. But once conversations increased and volume expanded, the internal inconsistencies grew louder. Their CRM held some information, but the team rarely updated it thoroughly. Instead, they relied on spreadsheets that had been patched together over the years. Different people kept different versions. Some files lived in shared drives. Others lived on laptops. A few had been duplicated so many times no one could remember which version was correct.

This fragmentation forced the team into a loop of constant checking and rechecking. A conversation with a seller might be logged in one place but not in another. A response that looked like a minor detail to one team member affected underwriting for another. Messages were buried inside email threads or text conversations. Notes were stored on personal devices as reminders that never reached the rest of the team. Decisions were delayed because data consistency could not be trusted.

The problem intensified around follow ups. When seller replies came in, they were not always seen in time. A hot lead could cool in hours if a team member missed the window to respond. The investor realized they were not losing deals due to competition. They were losing deals because the internal handoff between conversations, CRM updates, and next steps was no longer reliable. During busy weeks, follow up delays multiplied. The more leads they generated, the more opportunities they unintentionally neglected.

Operational drag became a daily reality. Tasks piled up. Team members repeated work because they shared uneven information. Leadership stopped focusing on strategy and spent increasing amounts of time clarifying details, chasing updates, or cleaning data. What had once been a confident machine slowly turned into a maze of reactive decisions.

In the emotional language of your brand schema, this is the “Before DealScale” phase. Frustration. Overwhelm. A growing sense that the business was operating in the dark, even though the team was putting in the hours.

The investor knew something had to change. They were running an operation that looked organized on paper but felt chaotic in practice. That gap was costing them speed and control.

Why Data Fragmentation Happens for Established Investors

Teams rarely choose complexity. It happens gradually as markets expand, marketing channels multiply, and responsibilities stretch. CRMs can only keep up when they are meticulously updated, and no investor wants to hire someone just to type notes into fields. Spreadsheets are appealing because they feel simple, but simplicity fades as soon as multiple people depend on them. Tools are added reactively, not strategically, until the system becomes a patchwork of temporary solutions held together by trust and habit.

For established investors, fragmentation is almost inevitable. But it is also the precise point where system design matters more than effort. Without a centralized operational backbone, scale becomes noisy instead of powerful.

How They Centralized Data and Communication

The investor eventually reached a tipping point. They wanted a deal desk that reflected the sophistication of their operation. That required a single system that combined CRM automation, centralized communication, lead scoring, and AI powered follow up. When they replaced their patchwork tools with one integrated platform, the difference was immediate.

The moment all data sources were imported into one location, the atmosphere inside the team shifted. The investor described it as going from scattered notes to a clean, panoramic view of the entire pipeline. Every deal suddenly had a complete, accurate timeline. The entire team could see the same seller conversations, the same status updates, the same next steps, and the same historical context. Guessing disappeared. Alignment increased. Meetings became shorter because everyone spoke from the same information.

Unified CRM dashboard showing all deal information in one place.

Automated CRM updates became the second major breakthrough. Instead of typing notes, entering updates, and manually changing statuses, the system handled everything. Every call, message, and interaction was logged instantly. Pipeline stages changed based on real seller behavior. Tasks were created without prompting. Follow up sequences adapted automatically. Team members no longer carried the mental load of keeping the CRM clean. Instead, they trusted the system to reflect reality in real time.

Lead scoring eliminated guesswork. The investor no longer relied on intuition or scattered notes to determine which sellers were serious. The system analyzed reply timing, message content, sentiment, engagement patterns, and readiness signals. High intent leads surfaced clearly. Low intent ones stopped consuming attention. The team shifted its energy toward the highest yield opportunities without debating which leads deserved priority.

The most transformative part of the new system was AI driven follow up. Before centralization, follow up was inconsistent. During slower weeks it was fine, but during busy ones it became a vulnerability. After implementation, follow up was never skipped, delayed, or forgotten. Every seller received timely, behavior based communication that felt personal and relevant. The investor described this as the single biggest contributor to faster deal movement.

Emotionally, the investor shifted into the “During Discovery” stage your schema outlines. They felt relief. They felt hope. Most importantly, they felt back in control.

What a Modern Investor Deal Desk Looks Like Now

Today’s top investors operate with a tighter workflow than ever before. Their systems no longer depend on memory or scattered habit. Instead, they rely on centralized data that gives them a single, authoritative view of the entire pipeline. CRM updates happen automatically and accurately. Follow ups are handled by AI that respects timing and seller signals. Voice cloning ensures communication stays authentic while scaling effortlessly. Predictive insights highlight which deals need immediate action. Every team member, regardless of role, works from the same dashboard with the same context.

This level of operational discipline used to require a full-time coordinator. Now it is available to any investor willing to centralize their workflow.

The Measurable Outcome

The investor expected improvement. They did not expect the magnitude. Deals moved through the pipeline faster because there were fewer delays, fewer missing details, and no pauses caused by manual updates. When communication became consistent and timely, sellers responded more readily. When tasks were automatically generated, nothing slipped. When statuses updated themselves, the team always knew what needed attention.

Time to close shortened. Confidence increased. Decision making sharpened.

According to McKinsey’s research on operational efficiency in real estate, workflow clarity and responsive communication are two of the strongest predictors of deal velocity.

The investor saw that in real time.

What made the outcome even more valuable was that they achieved it without adding headcount. No new coordinators. No analysts. No administrative team. The same people produced better results because their energy was no longer spent navigating broken processes. They focused on negotiation, underwriting, and decision making instead of searching for information.

Collaboration inside the team also transformed. Everyone operated from a single, reliable dataset. Misalignment vanished. Duplicate work stopped. Confusion evaporated. Team members trusted the system instead of chasing answers across tools.

This emotional shift mirrors your brand’s “After DealScale” arc: relief, clarity, confidence, empowerment.

Supporting Section: Visualizing the Operational Shift

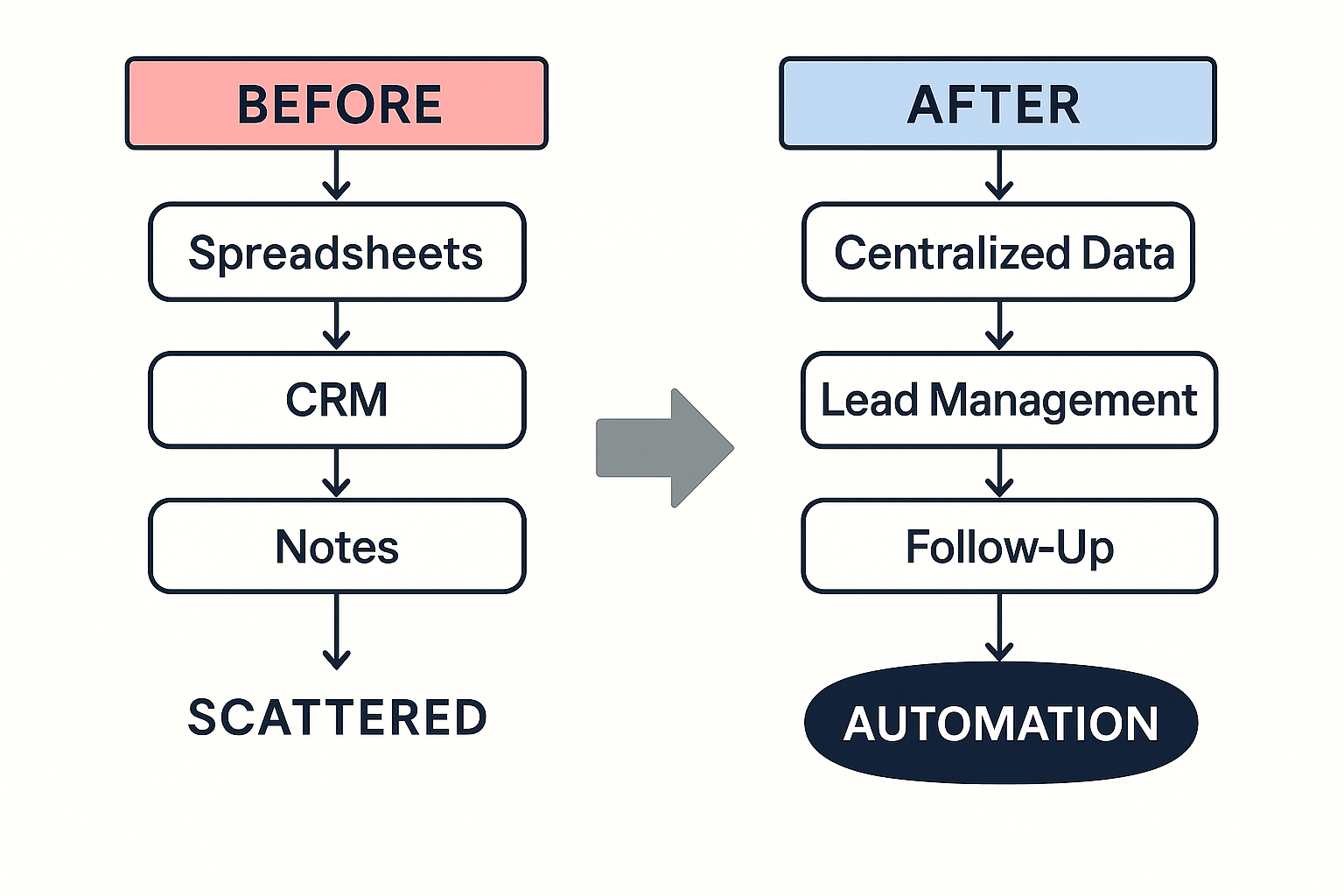

Before and after workflow chart showing transition from scattered systems to unified automation.

Before centralization, the investor’s process felt scattered. Tools did not talk to each other. Follow ups depended on whether someone remembered to send them. Status updates lagged behind reality. Ownership of tasks changed depending on who saw which message first. Deals delayed not because of strategy but because of workflow inconsistencies.

After centralization, the workflow became fluid. Information lived in one place. Automation drove momentum. Conversations fed directly into pipeline movement. Predictive signals highlighted where the team needed to focus. Instead of reacting to chaos, they acted with intention.

How DealScale Powered This Transformation

DealScale became the backbone of the investor’s operation because it replaced every fragile part of their system with a unified engine. They imported every spreadsheet, CRM export, and data source into a single structure without formatting headaches. The platform normalized everything automatically.

Workflow automation triggered updates and tasks after each interaction. Voice cloning captured the investor’s communication style and reproduced it across calls and messages. Predictive intelligence highlighted re engaged sellers, stalled leads, and approaching decision points. The deal desk shifted from manual maintenance to automated momentum.

This transformation aligns closely with our internal case study on AI advantage and investor efficiency, which readers can explore further here:

Why Larger Investors Are Turning to Automation

Complexity grows as operations expand. Larger teams manage more data, more communication, and more decision points than smaller ones. Manual CRM management does not scale with this complexity. AI does. Predictive workflows replace uncertainty with precision. Intent scoring replaces guesswork with clarity. Automation ensures that follow ups happen consistently, not when someone remembers.

Speed used to be a competitive advantage. Now it is a requirement. Investors who respond faster, follow up more reliably, and maintain cleaner data win deals that slower teams miss.

How to Know Your Operation Has Outgrown Its Tools

The investor featured here realized they had outgrown their systems long before they admitted it. Many investors experience the same signs. Processes feel harder than they should. Communication feels scattered. Task ownership feels unclear. The CRM reflects a partial truth, not a full one. Follow ups happen inconsistently. Weeks with high volume create overwhelm instead of momentum. More effort produces diminishing returns.

These are not signs of poor execution. They are signs of insufficient infrastructure. Once the foundation is upgraded, the entire operation becomes lighter and more effective.

Working Smarter Is the Investor Advantage

This investor’s journey reflects a broader truth about real estate at scale. Growth exposes operational flaws with mathematical certainty. Teams that rely on fragmented tools eventually hit ceilings they cannot push through by effort alone. But once the workflow becomes centralized and automated, everything changes. Deals move faster. Sellers stay engaged. Teams stay aligned. Leaders regain control of the pipeline. The business feels coherent again.

GIF representing smooth automated workflow.

The investor in this story did not work more hours to unlock their next level. They worked smarter by eliminating friction. They replaced chaos with clarity. They created an environment where their team could perform at its best because the system carried the operational load.

This is what a modern deal desk looks like when built with intention.

To see what this transformation could look like for your operation, book a DealScale walkthrough and let us map your workflow into a faster, clearer, more scalable version of itself.